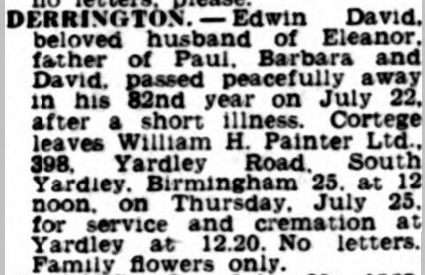

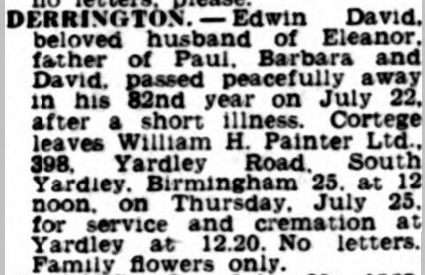

Full name: Edwin David Derrington.

Known as: Dave.

Date of birth: Sunday, 27th February, 1887.

Birthplace: Aston, Birmingham, England.

Date of death: Monday, 22nd July, 1968. (aged 81 years).

Place of death: 19 Beauchamp Avenue, Leamington, Warwickshire, England.

Cremated: Yardley Cemetery, Yardley, Birmingham, Warwickshire, England.

Signature:

Article taken from Birmingham Daily Post 23rd July 1968

Article taken from Birmingham Daily Post 23rd July 1968

1888-1892 - The Laurels, St. Oswald's Road, Small Heath, Birmingham, England.

1895-1911 - Tufa Mount, Willard Road, Yardley, Birmingham, England.

"The reason it is called Tufa Mount is because that is where they brought the stone from in the USA." - James Darby

"It is interesting to note that Willard Road is named after an American woman preacher Frances Willard due to the fact that the founder member of a local building firm Josiah Derrington and his son went to the USA in 1886.

They were so impressed by her that on her return they named Willard Road in her honour and built Tufa Mount after the type of stone which was reset in the part of America in which they were staying." - Taken from an unknown newspaper article.

"Mr. Edwards is a landscape gardener, and on seeing the name he told Mr. Powell that he hewed tons of Tufa stone every year from Tufa Mount, a hill near Chicago. This caused Mr. Powell to make enquiries of the builders of the house, the firm of Derrington. Apparently, in 1886, long before the days of productivity teams, Mr. Josiah Derrington and his son went to U.S.A. to study house-building trends.

Being keenly religious men and temperance advocates, they made it their business to meet a famous American woman preacher, Frances Willard. The year after their return they built an American style house in a new road at Yardley, calling the road Willard Road, and the house Tufa Mount." - Birmingham Weekly Post, Friday, October 5, 1951.

1918-1920 - 171, Alexander Road, Moseley, Birmingham, Warwickshire, England.

1922 - Manor House, Sheldon Lane, Lyndon End, Sheldon, Birmingham, Warwickshire, England.

1925-1930 - 293, Church Road, Yardley, Birmingham, Warwickshire, England.

Demolished late 1950s.

1936-1944 - 43 "Yardley House", Wherretts Well Lane, Solihull, Warwickshire, England.

Demolished late 1950s.

1962-1964 - 68, Chapel Lane, Chassetts Wood, Hockley Heath, Warwickshire, England.

1965-1968 - 87, Widney Road, Knowle, Warwickshire, England.

1898-1903 - King Edward VI: Camp Hill Grammar School for Boys, Stratford Road, Camp Hill, Birmingham, England (now occupied by Muath Trust).

Christmas 1898: Class X: Mr. W. B. Ainsworth / Set C1: Mr. W. B. Ainsworth

Mid-Summer 1899: Class VIII: Mr. G. J. Cook / Set C1: Mr. W. B. Ainsworth

Christmas 1899: Class VIB: Rev. D. Johnson / Set C1: Mr. W. B. Ainsworth

Mid-Summer 1900: Class VB: The Rev. John R. Worthington / Set B1: The Rev. John R. Worthington

Christmas 1900: Class VA: The Rev. John R. Worthington / Set B1: The Rev. John R. Worthington

Christmas 1901: Class II: Rev. A. Jamson Smith / Set A1: Mr. W. R. Bradley

Mid-Summer 1902: Class I: Rev. A. Jamson Smith / Set A1: Mr. W. R. Bradley

Christmas 1902: Class I: Rev. A. Jamson Smith / Set A1: Mr. W. R. Bradley

Mid-Summer 1903: Class I: Rev. A. Jamson Smith / Set A1: Mr. W. R. Bradley

Prizes:

July 1898: General Work (runner up)

December 1900: General Work & German

1908-1911: Assistant at Derrington & Sons

1911-1923: Partner at Derrington & Sons

1923-1963: Managing Director/Chairman at Derrington & Sons

A Brief History of Derrington Brick Makers and Builders Merchants

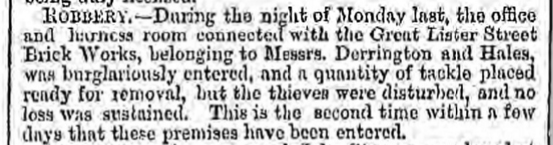

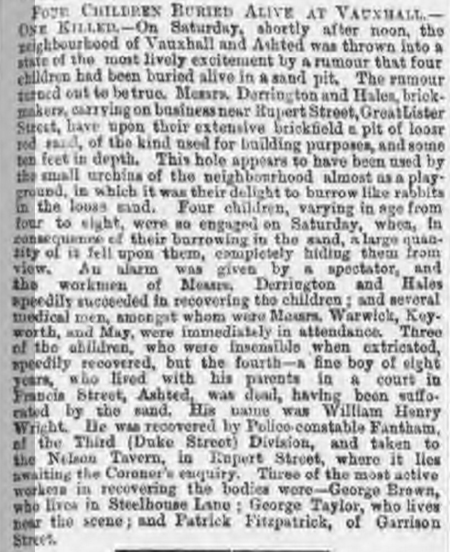

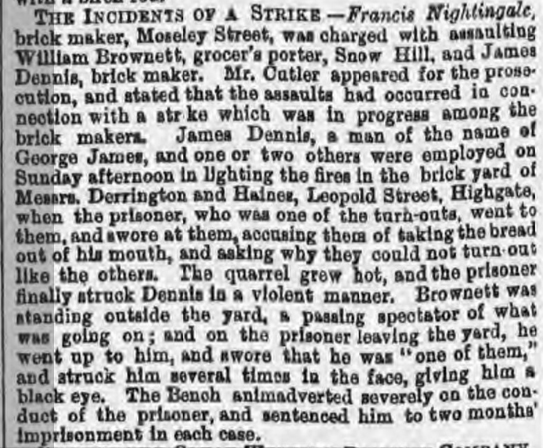

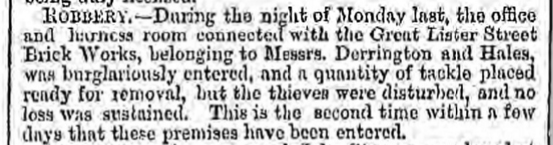

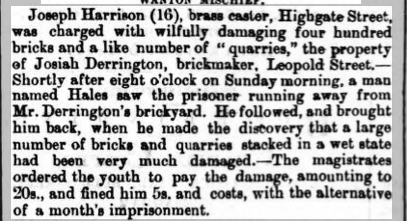

The company had its origins with Edward Hales (1828-1902), a practical brick maker who moulded bricks by hand using clay ground by a horse working a circular track. In 1858, Hales partnered with Josiah Derrington (1835-1920) and founded Derrington and Hales in Duddeston, Birmingham. The company held premises at Great Lister Street and Lord Street in Duddeston, and Leopold Street and Darwin Street in Highgate.

Following the dissolution of Derrington and Hales in 1869, Josiah went into business on his own account and brick manufacturing continued at Leopold Street. The company had also extended into the sale of building materials and a builder’s yard was established on Dartmouth Street in Duddeston.

Josiah’s son Josiah Pearce Derrington (1856-1924) joined the company at the turn of the decade and was closely followed by his brother Edwin George Derrington (1859-1943). A second builders’ yard was opened on Heneage Street in Duddeston c1872 and brick production was transferred to the Midland Brick Works on Garrison Lane, Small Heath c1876.

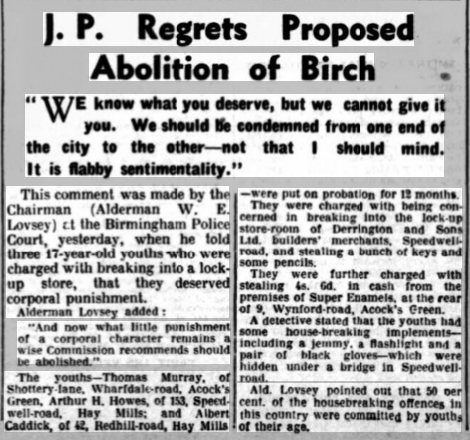

Josiah Junior. and Edwin were made partners in 1883 and the company became known as Derrington and Sons. Further builders’ yards were opened on Lawley Street in Duddeston and South Road in Camp Hill, and a brickworks was opened on Speedwell Road in Hay Mills. All brick manufacturing was transferred to Hay Mills in 1892.

In 1901 Josiah Snr. retired and full control of the company was given to his sons. Lawley Street and South Road premises closed shortly before the arrival of Edwin’s son Edwin David Derrington (1887-1968) in 1908.

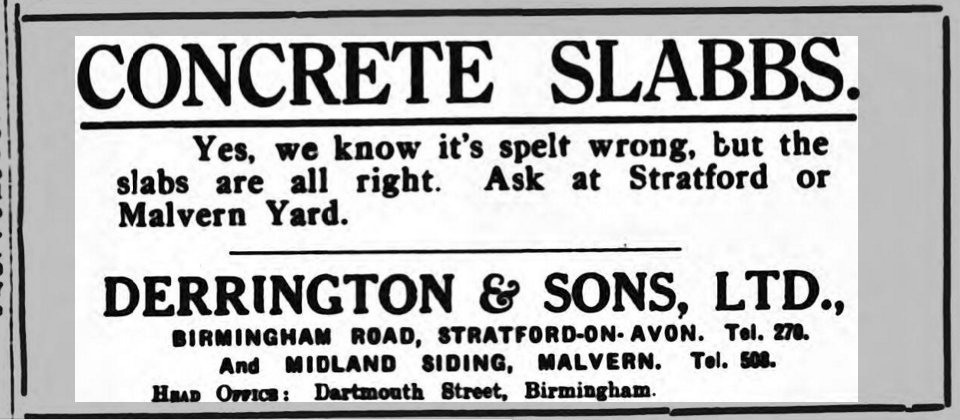

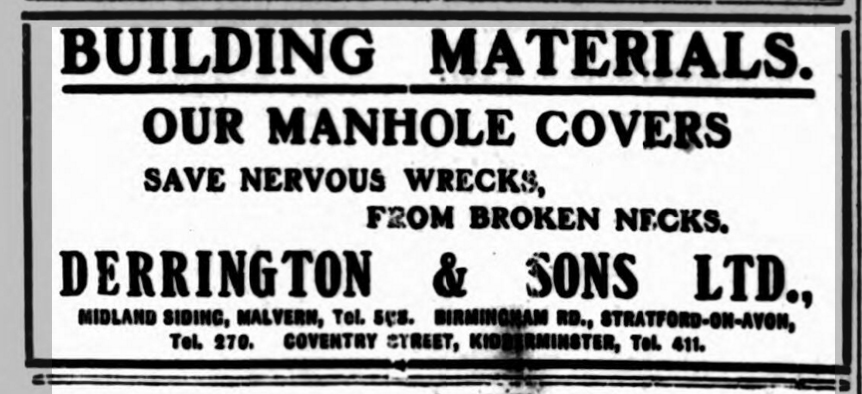

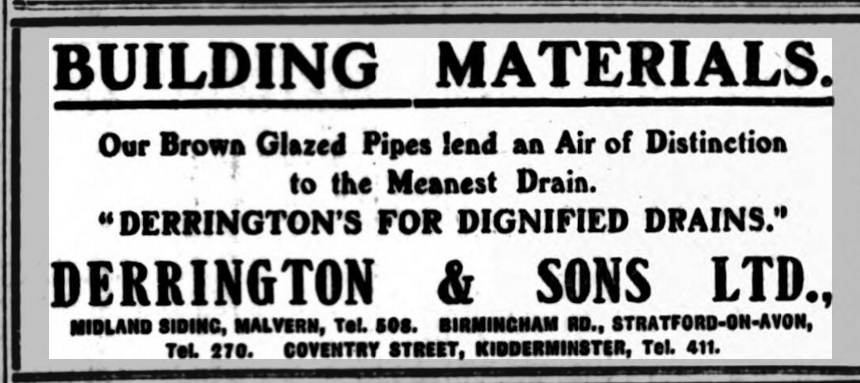

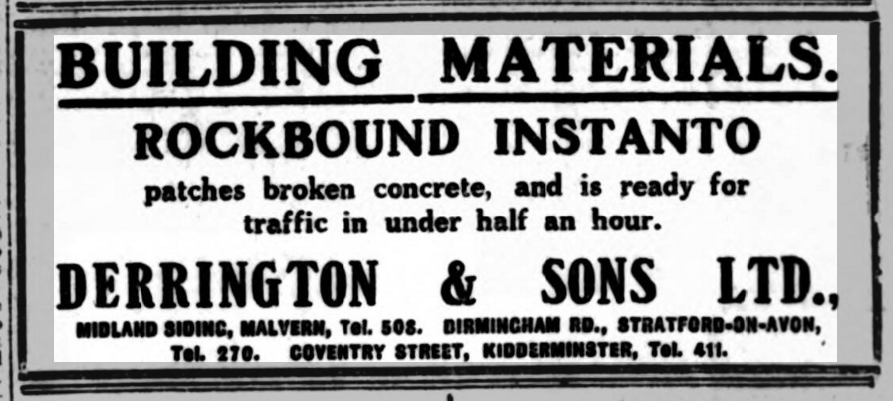

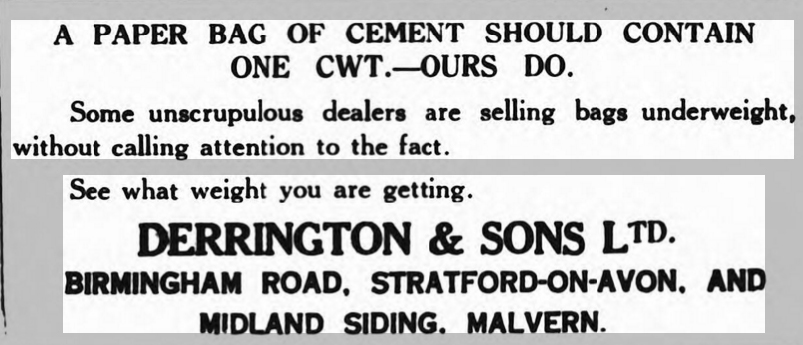

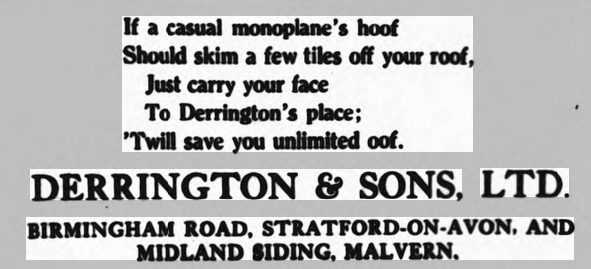

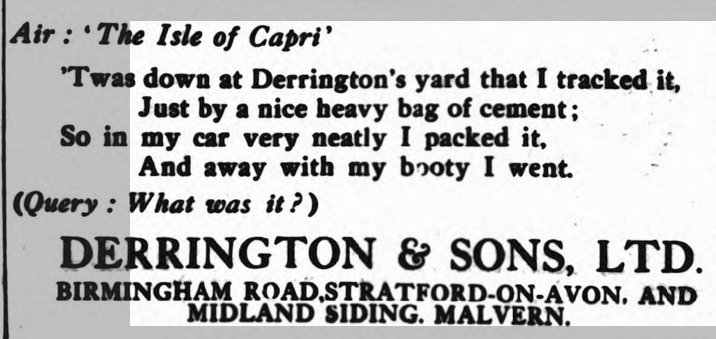

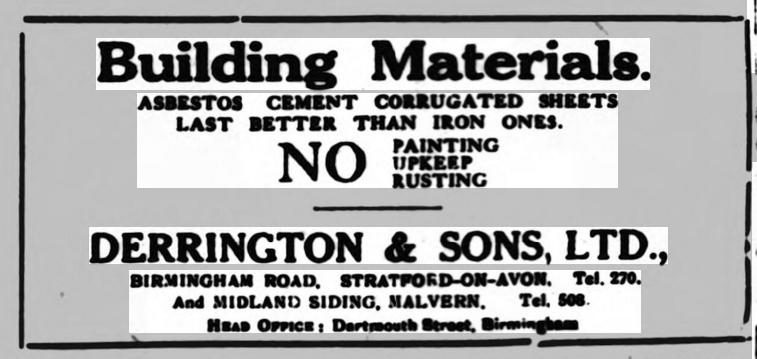

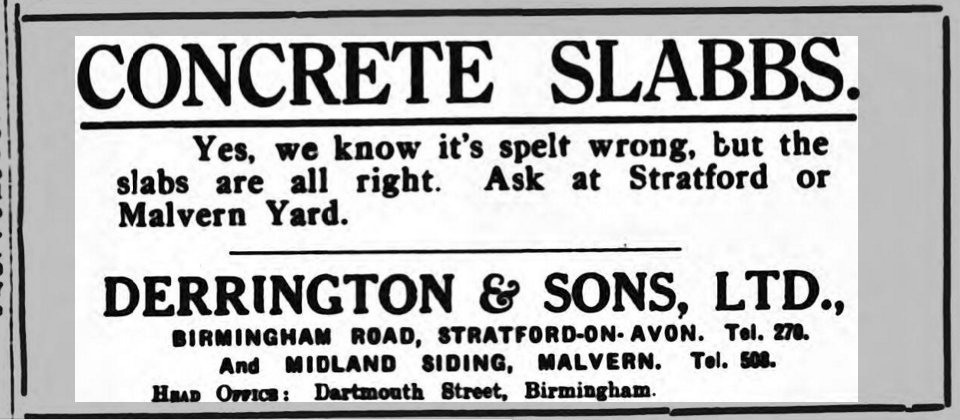

David became a partner in 1911 following the retirement of Josiah Jnr., and in 1912 a builders’ yard was opened at Midland Siding in Great Malvern.

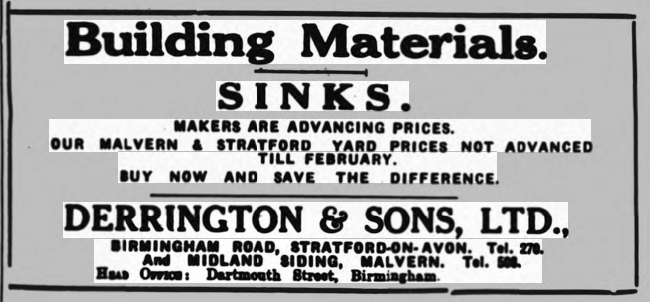

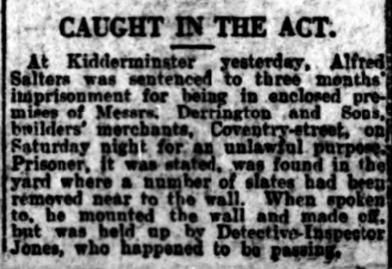

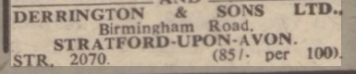

In 1923 Edwin retired and David became managing director. In the same year a branch was opened on the Birmingham Road in Stratford-upon-Avon, and a Kidderminster branch was opened on Coventry Street in 1928.

In 1930 the firm became a limited company and David became chairman.

David retired in 1963 and his sons Paul Derrington (1912-2000) and David Pearce Derrington (1929-1990) became joint directors.

By 1990 the company had changed its name to Derrington Builders Merchants and was under the control of Paul’s son David James Derrington (1946-) and David’s son Nicholas Derrington (1960-). In 1992 the company filed insolvency proceedings thus bringing an end to the company after 134 years and five generations.

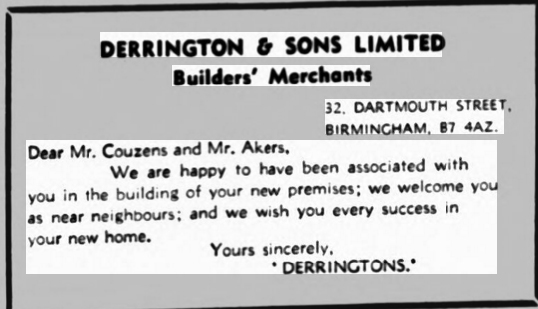

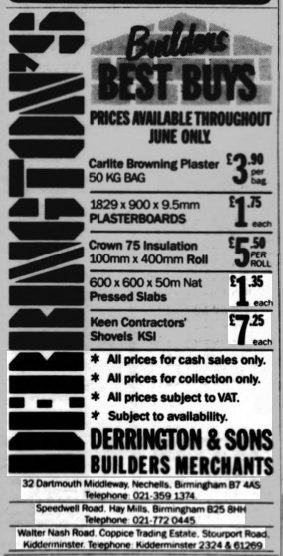

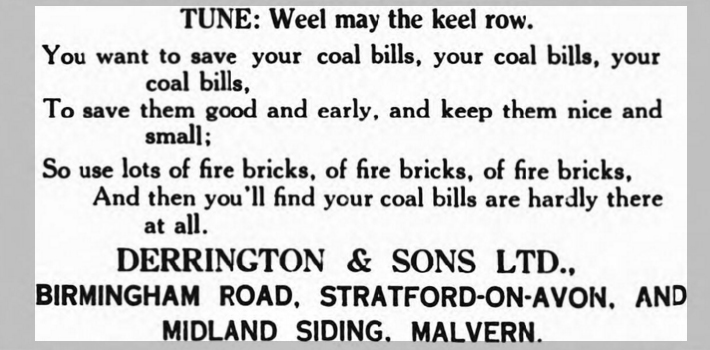

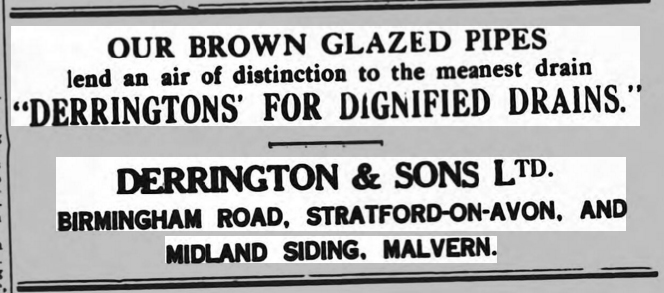

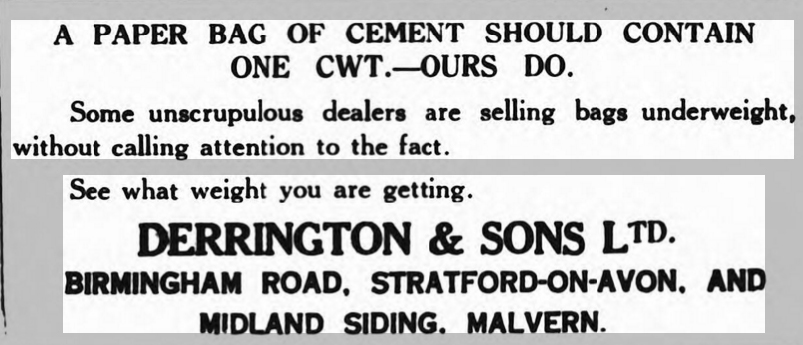

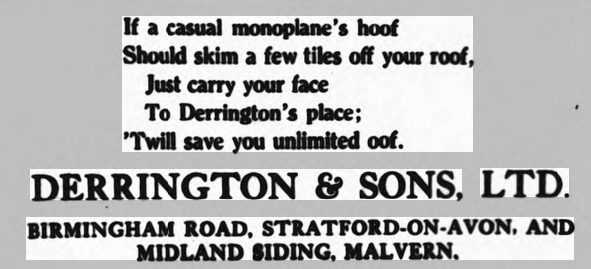

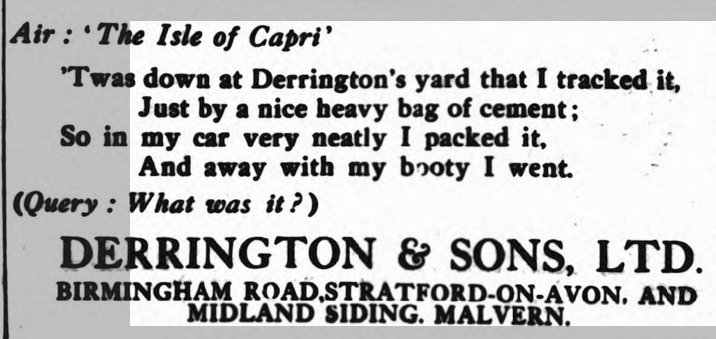

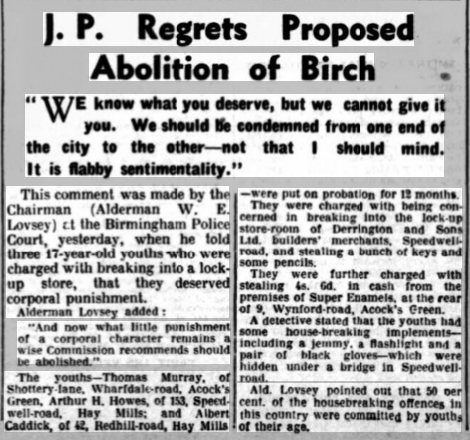

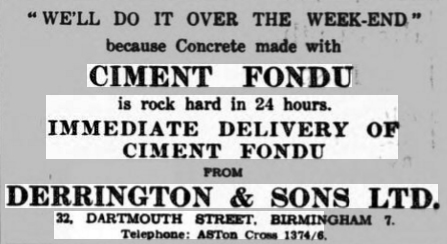

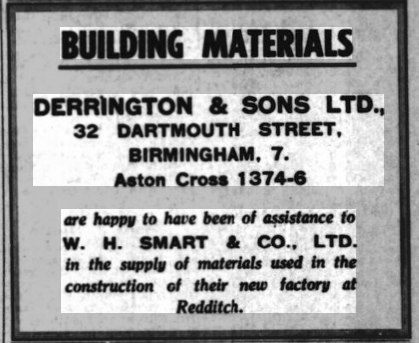

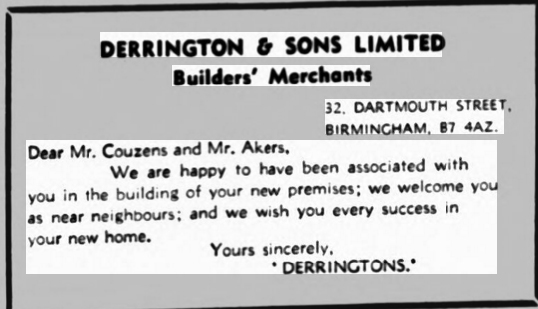

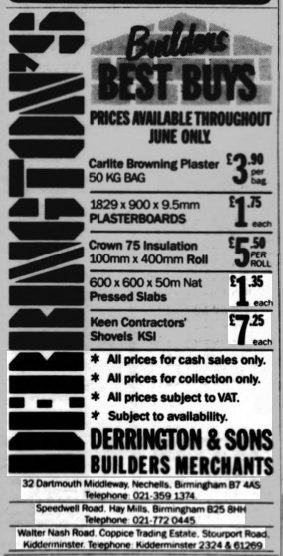

Newspaper Articles and Adverts

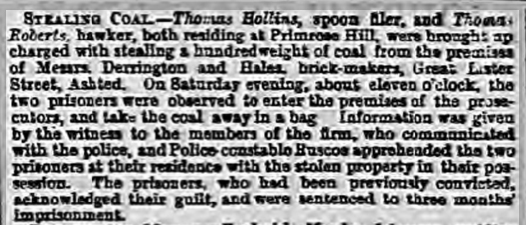

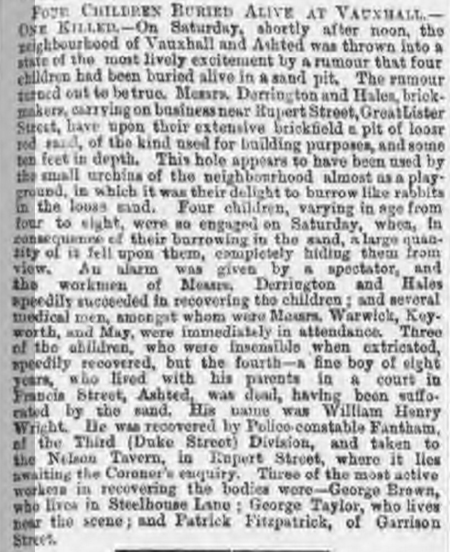

Article taken from Birmingham Daily Post 29th May 1862

Article taken from Birmingham Daily Post 14th December 1863

Article taken from Birmingham Daily Post 15th November 1864

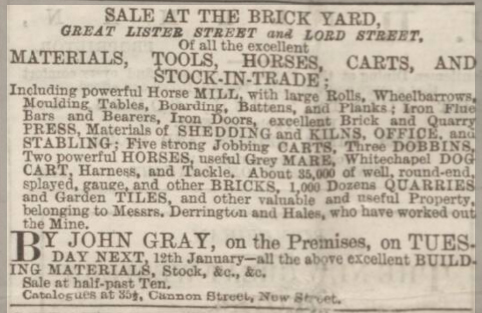

Article taken from Birmingham Journal 4th February 1865

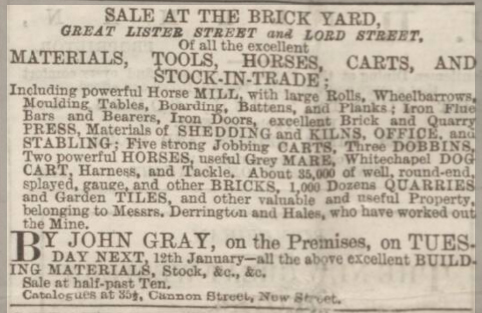

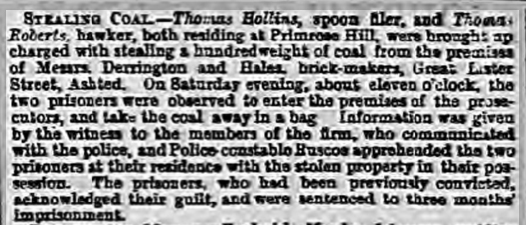

Article taken from Aris's Birmingham Gazette 9th January 1869

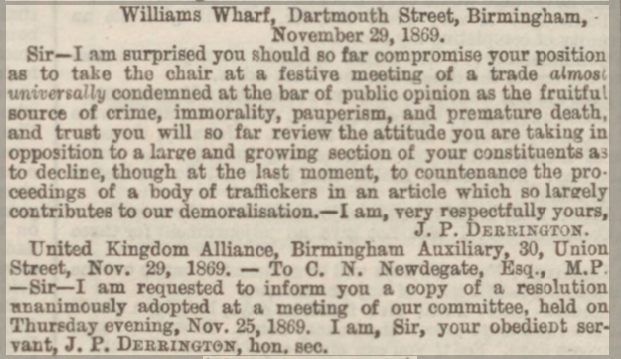

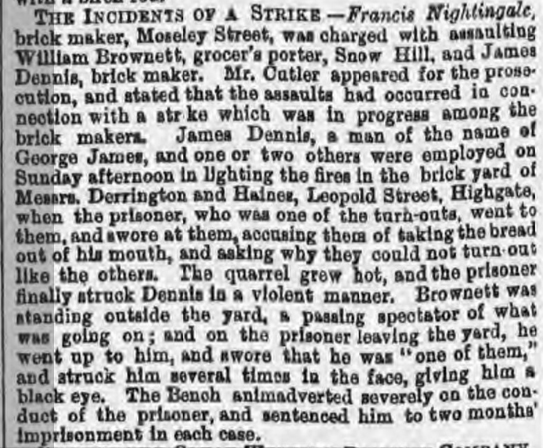

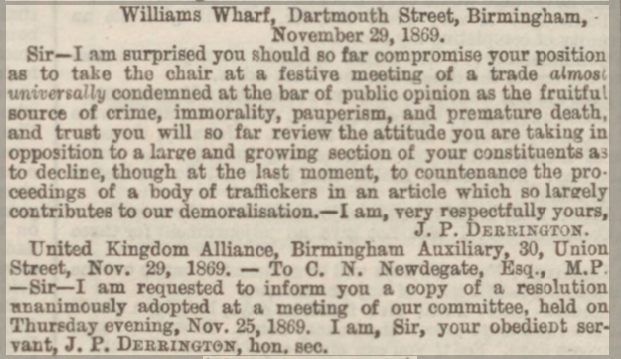

Article taken from Birmingham Daily Gazette 2nd December 1869

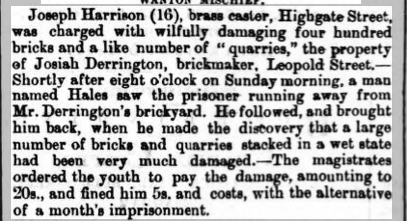

Article taken from Birmingham Mail 2nd October 1871

Article taken from Coventry Herald 30th March 1923

Article taken from Birmingham Daily Gazette 13th March 1928

Article taken from The Tewkesbury Register, and Agricultural Gazette 12th April 1930

Article taken from The Tewkesbury Register, and Agricultural Gazette 7th June 1930

Article taken from The Tewkesbury Register, and Agricultural Gazette 5th July 1930

Article taken from The Tewkesbury Register, and Agricultural Gazette 4th October 1930

Article taken from The Tewkesbury Register, and Agricultural Gazette 8th November 1930

Article taken from The Tewkesbury Register, and Agricultural Gazette 13th December 1930

Article taken from The Tewkesbury Register, and Agricultural Gazette 21st February 1931

Article taken from The Tewkesbury Register, and Agricultural Gazette 5th September 1931

Article taken from The Tewkesbury Register, and Agricultural Gazette 24th October 1931

Article taken from The Tewkesbury Register, and Agricultural Gazette 2nd January 1932

Article taken from The Tewkesbury Register, and Agricultural Gazette 6th February 1932

Article taken from The Tewkesbury Register, and Agricultural Gazette 2nd April 1932

Article taken from Evesham Standard & West Midland Observer 4th June 1932

Article taken from Evesham Standard & West Midland Observer 6th August 1932

Article taken from Evesham Standard & West Midland Observer 1st October 1932

Article taken from Evesham Standard & West Midland Observer 5th November 1932

Article taken from Evesham Standard & West Midland Observer 3rd December 1932

Article taken from Evesham Standard & West Midland Observer 18th March 1933

Article taken from Evesham Standard & West Midland Observer 20th May 1933

Article taken from The Tewkesbury Register, and Agricultural Gazette 2nd December 1933

Article taken from The Tewkesbury Register, and Agricultural Gazette 5th May 1934

Article taken from The Tewkesbury Register, and Agricultural Gazette 3rd November 1934

Article taken from The Tewkesbury Register, and Agricultural Gazette 9th March 1935

Article taken from The Tewkesbury Register, and Agricultural Gazette 6th April 1935

Article taken from The Tewkesbury Register, and Agricultural Gazette 1st June 1935

Article taken from The Tewkesbury Register, and Agricultural Gazette 28th December 1935

Article taken from Birmingham Daily Gazette 26th March 1938

Article taken from The Tewkesbury Register, and Agricultural Gazette 23rd December 1950

Article taken from The Tewkesbury Register, and Agricultural Gazette 2nd July 1955

Article taken from The Tewkesbury Register, and Agricultural Gazette 2nd July 1955

Article taken from Birmingham Daily Post 9th December 1958

Article taken from Birmingham Weekly Post 1st April 1960

Article taken from Birmingham Daily Post 12th October 1961

Article taken from The Tewkesbury Register, and Agricultural Gazette 18th May 1962

Article taken from The Tewkesbury Register, and Agricultural Gazette 10th December 1965

Article taken from Birmingham Daily Post 2nd March 1966

Article taken from Birmingham Daily Post 8th December 1970

Article taken from Sandwell Evening Mail 22nd June 1987

Regiment: Royal Army Medical Corps.

Division: 24th Division

Regimental No.: 50962

Rank: Private (1914), Warrant Officer Class 2, became Quartermaster Sergeant

Edwin George Derrington.

Gross value of Estate: £23,827 10s. 7d.

Net value of Estate: £22,116 18s. 0d.

Estate Duty: £2,573 3s. 2d.

"4. I BEQUEATH free of duty the following legacies:- To my said son Edwin David Derrington all my personal chattels at his residence."

"11. I GIVE all my property and possessions whatsoever to my said sons Edwin David Derrington and George Herbert Derrington in equal shares absolutely."

Half of Estate: about £9,196.

Gross value of Estate: £38,916 4s. 7d.

Net value of Estate: £38,685 19s. 0d.

Estate Duty: £13,486 9s. 0d.

I EDWIN DAVID DERRINGTON of 68 Chapel Lane Chessetts Wood Hockley Heath in the County of Warwick Company Director HEREBY REVOKE all testamentary dispositions heretofore made by me AND DECLARE this to be my last Will which I make this twenty-first day February One thousand nine hundred and sixty four

1. I APPOINT MIDLAND BANK EXECUTOR & TRUSTEE COMPANY LIMITED (hereinafter called "the Company") and my son PAUL DERRINGTON (who together with the Company are herein-after called "my Trustees") to be the Executors and Trustees of this my Will AND I DECLARE that the Company is so appointed upon its published Standard Conditions as now in force (as if the same were here set out) with remuneration as provided by those Conditions and the Company's Standard Scale of Fees in force at my death AND I DESIRE that the firm of Huggins & Company shall be employed as Solicitors in connection with my Estate unless the Company sees reason to the contrary

2. I GIVE to my wife ELEANOR DERRINGTON free of duty my personal chattels as defined in Form 11 of the Statutory Will Forms 1925 which Form is incorporated in this my Will and a legacy of One thousand pounds free of duty to be paid to her within two months of my death

3. (1) I GIVE to each of my sons who shall survive me Five hundred Shares in Derrington & Sons Limited free of duty

(2) I GIVE to my daughter BARBARA MORRIS a legacy of Two thousand pounds free of duty

4. I GIVE to MRS. AMY CAROLINE DAVEY a legacy of Two hundred pounds free of duty in acknowledgment of many years faithful service whether or not she shall be in my service at the time of my death

5. I GIVE all my real and personal property whatsoever of which I shall be competent to dispose at my death by virtue of any interest or any general power (except property otherwise disposed of by this my Will or any Codicil hereto) unto my Trustees upon trust to sell and convert the same into money with power to postpone such sale and conversion indefinitely without being responsible for loss and so that no reversionary interest shall be sold before it falls into possession unless my Trustees see special reason for earlier sale And I direct that the income of the unsold part thereof for the time being howsoever constituted or invested shall as from my death be applied in the same manner as if it were income of investments of the proceeds of the sale and conversion thereof

6. I DIRECT that no sale shall be made of the house with the land appurtenant thereto in which I shall have been ordinarily resident at my death during the life of my said wife without her consent in writing and that until the sale thereof my Trustees shall permit her to occupy the same so long as she shall so desire she keeping the same in repair and paying all outgoings in respect thereof

7. MY TRUSTEES shall out of the proceeds of such sale and conversion and out of my ready money pay my funeral and testamentary expenses (including all Estate Duty leviable at my death in respect of my estate) and debts and the legacies given by this my Will or any Codicil hereto and shall invest the residue of the said monies in or upon any investments hereby authorised with power to vary the same or any of them for others of a like nature

8. MY TRUSTEES shall stand possessed of the residue of the said money and of the investments for the time being representing the same and of such part of my Estate as shall for the time being remain unsold (all of which are hereinafter together referred to as "the Trust Fund") upon the trusts following namely:-

(1) Upon Trust to pay the income of the Trust Fund to my said wife during her life

(2) After the death of my said wife as to the capital and future income of the Trust Fund IN TRUST absolutely for all or any my children or child living at my death if more than one in equal shares

(3) Provided that if any child of mine shall have died in my lifetime leaving a child or children living at my death such child or children who attain the age of twenty one years or marry under that age shall take by substitution if more than one in equal shares the share or interest in the Trust Fund which his her or their parent would have taken under the trusts hereinbefore declared if such parent had survived me

9. (1) TRUST monies may be invested:-

(a) in any investments for the time being authorised as investments for trust monies; or

(b) on real or leasehold securities in England or Wales; or

(c) in or on the purchase of any freehold property in England or Wales of any leasehold or underleasehold property in England or Wales held upon a lease or underlease having not less than Sixty years unexpired at the date of investment

(d) in or on the stock or securities of any British State Dominion Colony or Dependency or any province thereof or of any municipal corporation power water gas electricity harbour or local authority in Great Britain or Northern Ireland or in any British State Dominion Colony or Dependency; or

(e) in or on the bonds mortgages debentures or debenture stock or guaranteed or preference or ordinary stock or shares of any company public or private incorporated or carrying on business in Great Britain or Northern Ireland or in any British State Dominion Colony or Dependency or any province thereof which shall have paid a dividend at the rate of at least Five per centum per annum on the amount for the time being paid upon its ordinary stock or shares for each of the five years prior to the date of investment; or

(f) in or on the shares whether preference or ordinary or debentures or debenture stock of the said Company known as Derrington & Sons Limited Builders' Merchants of Birmingham and elsewhere or in or on such shares debentures or debenture stock of any Company with which such Company as aforesaid shall be amalgamated or to which it shall be sold or reconstructed

(2) Trust monies may at the discretion of my Trustees at the request of my said wife be laid out to an amount not exceeding Six thousand pounds in the purchase or building of a dwellinghouse with suitable outbuildings and with or without a garden and land to be held therewith (including such sum as may be required in repairing improving or decorating the same) as a residence for my said wife Any such dwellinghouse land and premises shall be situate in England or Wales and be either freehold or leasehold or underleabehold held for a term of which not less than Sixty years shall be unexpired at the time of purchase and shall be assured to my Trustees according to the tenure thereof upon trust for sale

10. ANY child of mine shall ie at liberty by agreement with my Trustees to purchase any shares debentures or debenture stock belonging to my estate in the said Company known as Derrington & Sons Limited or the shares debentures or debenture stock of any company with which such Company as aforesaid shall be amalgamated or to which it shall be sold or reconstructed at a price to be fixed by an independent Chartered Accountant to be chosen by my Trustees and my Trustees may make such arrangements with him or her for the payment of the purchase money therefor or any part thereof by such instalments with such interest at such times and in such manner as my Trustees shall think fit

11. I DIRECT that a gift of Two thousand five hundred pounds made by me in or about the year One thousand nine hundred and fifty seven to my son DAVID PEARCE DERRINGTON and any gift exceeding One hundred pounds in amount or value at any one time which I may hereafter make to any of -my three children (less any Estate Duty payable in respect thereof by him or her) shall in default of any direction to the contrary in writing under my hand be taken in or towards satisfaction of the share in the Trust Fund of any such child of mine to whom such gift shall have been ' made or of his or her child or children taking by substitution as aforesaid and shall be brought into hotchpot and accounted for accordingly

12. I DIRECT that the gift of Two thousand shares in Derrington & Sons Limited which I have recently made to my said son David Pearce Derrington shall not be brought into account in or towards satisfaction of the share in the Trust Fund of my said son or of his child or children taking by substitution as aforesaid and that all Death Duties and interest thereon payable on my death in respect of the said gift or the Shares comprised therein shall be paid as part of my testamentary expenses out of my residuary estate

13. FORM V1 contained in Part 1 of the Statutory Will Forms 1925 is incorporated in this my Will

14. THE power of appointing a new or additional trustee or new or additional trustees hereof shall be vested in my said wife during her life

15. THE expression "my Trustees" shall where the context so admits include the trustees or trustee for the time being hereof IN WITNESS whereof I have hereunto set my hand the day and year first before written EDWIN DAVID DERRINGTON

I, EDWIN DAVID DMRINGTON of 87 Widney Road, Knowle in the County of Warwick Retired Company Director HERBY DECLARE this to be a Codicil which I make this tenth day of December Nineteen hundred and sixty-five to my Will which bears date the Twenty-first day of February Nineteen hundred and sixty-four

1. I REVOKE Clause 3 of my said Will and in substitution therefor I GIVE to each of my children who shall survive me 500 Shares in Derrington & Sons Limited free of duty

2. IN all other respects I confirm my said will

IN WITNESS whereof I have hereunto set my hand the day and year first before written EDWIN DAVID DERRINGTON

Page updated 8th November, 2020.